The Greatest Guide To Commercial Insurance In Toccoa Ga

Wiki Article

Medicare Medicaid In Toccoa Ga Things To Know Before You Get This

Table of ContentsThe 3-Minute Rule for Annuities In Toccoa GaThe Greatest Guide To Final Expense In Toccoa Ga8 Simple Techniques For Life Insurance In Toccoa GaSome Ideas on Medicare Medicaid In Toccoa Ga You Should Know

An economic consultant can additionally aid you make a decision exactly how ideal to accomplish objectives like saving for your youngster's college education and learning or repaying your financial debt. Monetary advisors are not as fluent in tax obligation legislation as an accounting professional might be, they can use some assistance in the tax preparation process.Some economic experts supply estate preparation solutions to their customers. They might be educated in estate preparation, or they might desire to collaborate with your estate attorney to respond to concerns concerning life insurance, counts on and what ought to be done with your financial investments after you pass away. Lastly, it's vital for economic experts to remain up to day with the market, economic problems and advising finest practices.

To sell investment items, consultants must pass the pertinent Financial Market Regulatory Authority-administered examinations such as the SIE or Series 6 examinations to acquire their qualification. Advisors who wish to offer annuities or other insurance products have to have a state insurance coverage certificate in the state in which they intend to market them.

Medicare Medicaid In Toccoa Ga Can Be Fun For Everyone

Allow's claim you have $5 million in possessions to handle. You work with an advisor who charges you 0. 50% of AUM each year to help you. This means that the expert will certainly obtain $25,000 a year in charges for managing your financial investments. As a result of the normal charge structure, several advisors will certainly not collaborate with customers who have under $1 million in assets to be managed.Financiers with smaller profiles could seek a financial consultant that charges a per hour cost as opposed to a percentage of AUM. Per hour fees for consultants normally run between $200 and $400 an hour. The even more complex your monetary circumstance is, the more time your consultant will certainly need to commit to handling your assets, making it much more expensive.

Advisors are proficient professionals who can aid you create a plan for financial success and execute it. You could also think about connecting to an advisor if your personal monetary situations have lately ended up being more challenging. This could suggest buying a residence, marrying, having youngsters or getting a huge inheritance.

Getting The Insurance In Toccoa Ga To Work

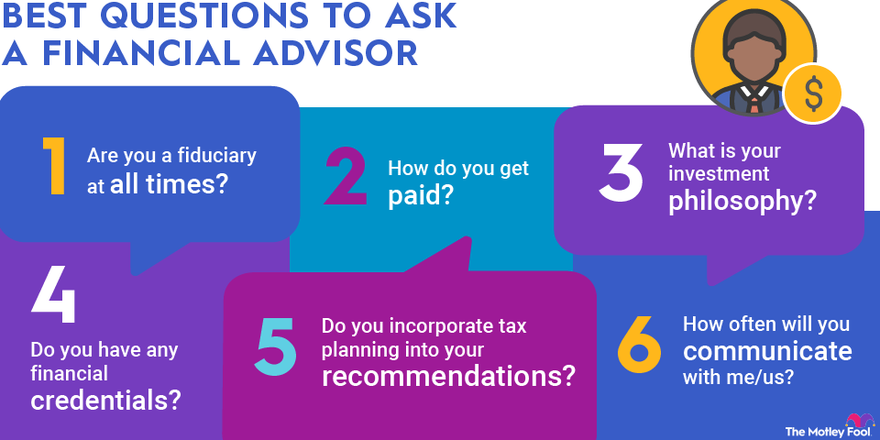

Before you fulfill with the consultant for an initial assessment, consider what services are most essential to you. Older adults might need aid with retired life planning, while younger grownups (Final Expense in Toccoa, GA) might be searching for the best means to invest an inheritance or starting a service. You'll want to choose an expert who has experience with the services you want.How much time have you been recommending? What service check my blog were you in before you entered economic encouraging? Who composes your typical customer base? Can you give me with names of some of your customers so I can discuss your solutions with them? Will I be collaborating with you straight or with an associate consultant? You may also wish to check out some sample financial strategies from the advisor.

If all the samples you're provided are the very same or similar, it may be an indication that this advisor does not correctly personalize their recommendations for each customer. There are 3 primary sorts of financial encouraging experts: Qualified Monetary Planner experts, Chartered Financial Experts and Personal Financial Specialists - https://flipboard.com/@jstinsurance1/-health-insurance-in-toccoa-georgia/a-yPD6uT75Q9y3EjmPdHarjA%3Aa%3A4045383819-e6c58aa3fb%2Fjstinsurance.com. The Licensed Financial Organizer professional (CFP specialist) certification shows that a consultant has actually satisfied a specialist and moral requirement set by the CFP Board

All About Insurance In Toccoa Ga

When picking a monetary expert, think about somebody with an expert credential like a CFP or CFA - http://tupalo.com/en/users/5593708. You might additionally think about an expert who has experience in the services that are most crucial to youThese advisors are usually filled with disputes of rate of interest they're more salesmen than advisors. That's why it's important that you have a consultant who works only in your finest rate of interest. If you're looking for an expert that can absolutely supply actual worth to you, it is essential to research a variety of prospective choices, not simply select the given name that promotes to you.

Currently, many advisors need to act in your "best interest," however what that entails can be nearly unenforceable, except in the most egregious situations. You'll require to find a genuine fiduciary. "The very first examination for a great financial consultant is if they are benefiting you, as your supporter," claims Ed Slott, CPA and creator of "That's what a fiduciary is, yet everyone claims that, so you'll require various other indications than the advisor's say-so or even their qualifications." Slott recommends that customers want to see whether consultants spend in their recurring education and learning around tax planning for retired life savings such as 401(k) and individual retirement account accounts.

"They need to verify it to you by revealing they have taken serious ongoing training in retired life tax and estate preparation," he claims. "You need to not invest with any type of consultant who doesn't spend in their education.

Report this wiki page